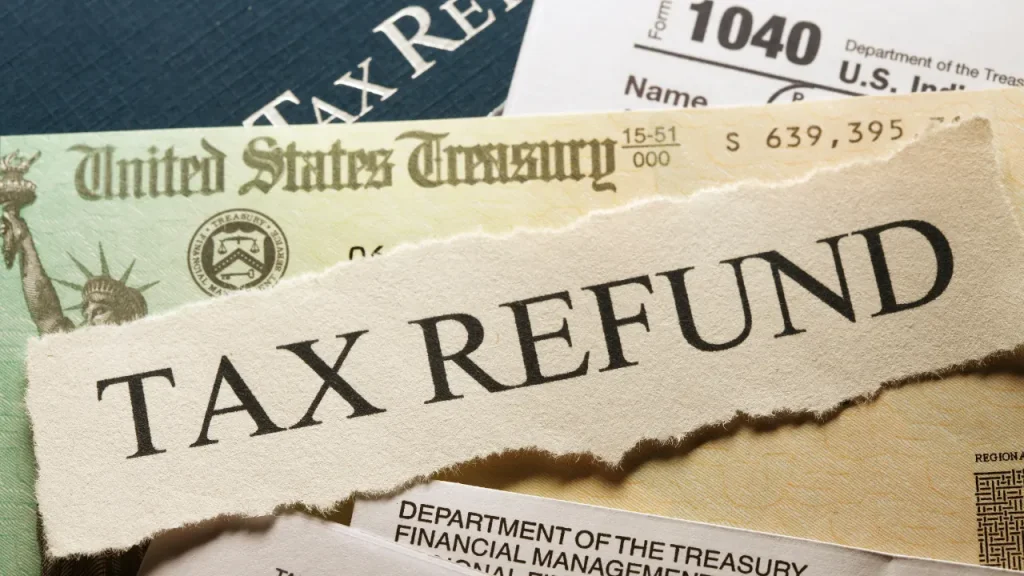

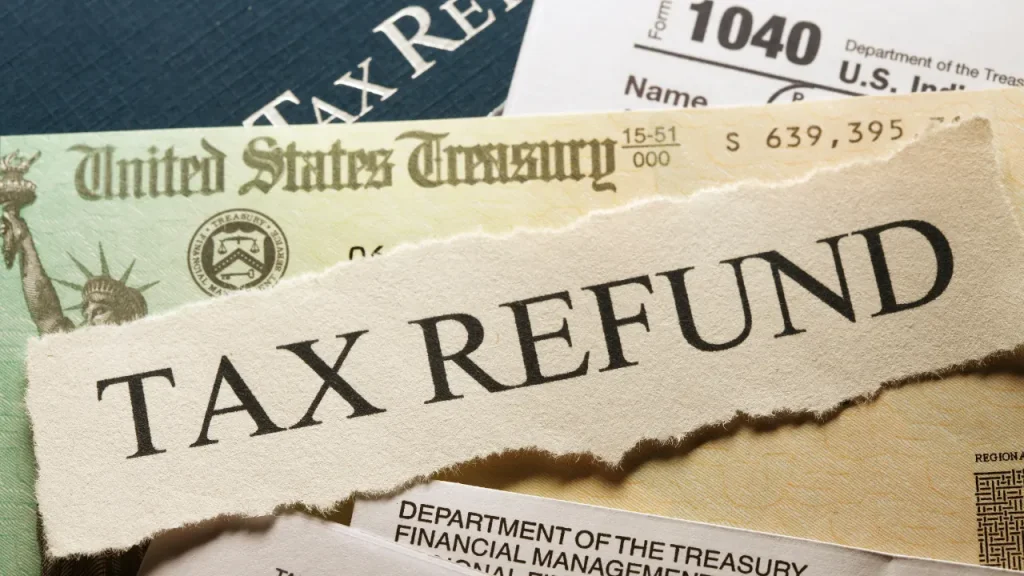

IRS Tax Refund 2026 Schedule: Estimated Refund Dates & Payment Timeline.As the 2026 tax filing season gets closer, one question is already on millions of Americans’ minds: When will my IRS tax refund arrive? For many households, tax refunds play a key role in covering essential expenses, paying down debt, or rebuilding savings.

While the IRS does not publish an exact refund date for every taxpayer, refund timelines follow clear patterns every year. If you understand how filing dates, payment methods, and tax credits affect processing, you can make a realistic estimate of when your refund will hit your bank account.

This Google Discover–friendly guide explains everything you need to know about IRS Tax Refund 2026 in simple, clear terms.

Overview of IRS Tax Refund 2026 Schedule

| Category | Details |

|---|---|

| Tax Year | 2025 |

| Filing Year | 2026 |

| IRS Filing Start | Late January 2026 (expected) |

| Fastest Refund Method | E-file + Direct Deposit |

| Average Refund Time | 10–21 days |

| Paper Return Refund Time | 6–8 weeks or longer |

| Refund Tracking Tool | Where’s My Refund |

| Official Website | irs.gov |

When Will IRS Tax Refunds Start in 2026?

Based on previous years, the IRS is expected to begin accepting tax returns in late January 2026. Once your return is accepted, the refund clock starts.

For most taxpayers who:

- File electronically

- Use direct deposit

- Submit an error-free return

Refunds often arrive within 10 to 21 days.

Estimated IRS Refund Timeline for 2026

Early Filers (Late January – Early February)

- Refunds may arrive in 10–14 days

- Best chance for fastest payment

- Fewer system backlogs

Mid-Season Filers (Mid-February – March)

- Refunds usually arrive in 14–21 days

- Some delays possible due to high filing volume

Late Filers (April)

- Refunds may take 3–4 weeks

- Processing slows near the deadline

Paper Filers

- Refunds may take 6–8 weeks or more

- Strongly discouraged if speed matters

Why Some Refunds Are Delayed

Even if you e-file, refunds can be delayed for several reasons:

- Errors in personal details or bank information

- Missing or mismatched income

- Identity verification checks

- Review of certain tax credits

- Outstanding federal or state debts

In most cases, the IRS simply needs more time to verify information.

Credits That Can Delay Refunds

Returns claiming certain credits may be legally held for additional review, including:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

If you claim these credits, refunds often arrive in late February or early March, even if you file early.

How to Track Your IRS Refund in 2026

Once your return is accepted, you can track your refund using the IRS refund tracker. You’ll need:

- Social Security Number

- Filing status

- Exact refund amount

The tool updates once per day, so checking repeatedly won’t speed things up.

How to Get Your Refund Faster

Tax professionals consistently recommend:

- Filing electronically

- Choosing direct deposit

- Double-checking names, SSNs, and bank details

- Reporting all income accurately

- Filing early, but only after receiving all tax forms

These steps significantly reduce the risk of delays.

What If Your Refund Is Smaller Than Expected?

A lower refund may happen if:

- Your income increased

- Tax withholding changed

- Credits were reduced

- You owed back taxes or other debts

Understanding these factors can prevent surprises.

FAQs for IRS Tax Refund 2026 Schedule

How soon can I expect my IRS refund in 2026?

Most e-filed returns with direct deposit are processed within 10–21 days.

Does filing early guarantee a faster refund?

It improves your chances, but accuracy matters more than speed.

Is direct deposit really faster than a check?

Yes. Direct deposit is the fastest and safest option.

Why does the IRS hold some refunds longer?

To prevent fraud and verify credits or identity information.